salt tax deduction repeal

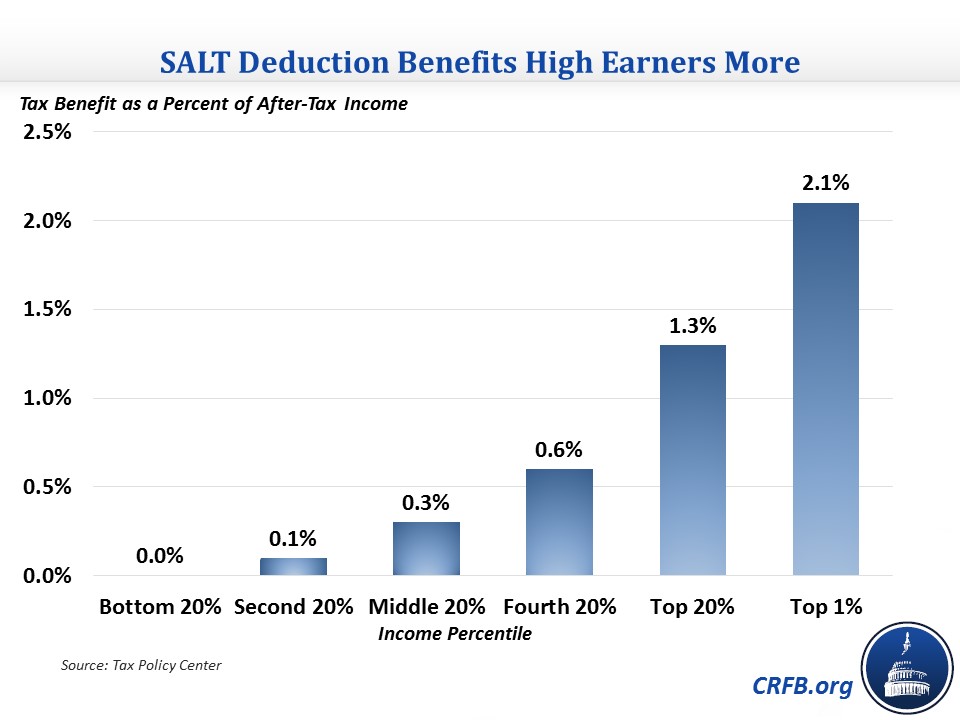

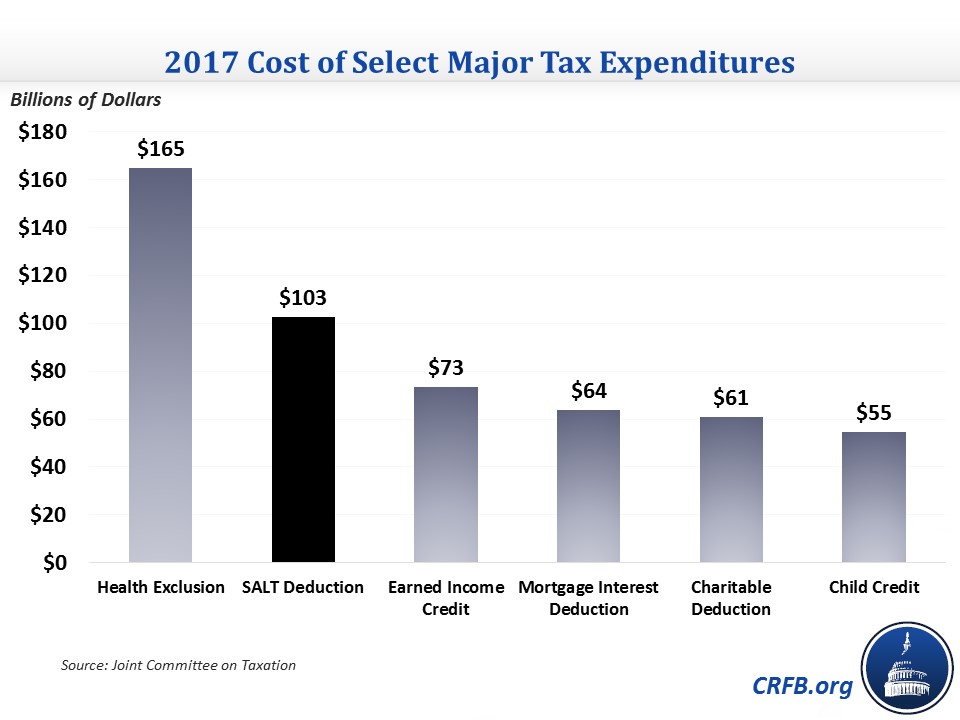

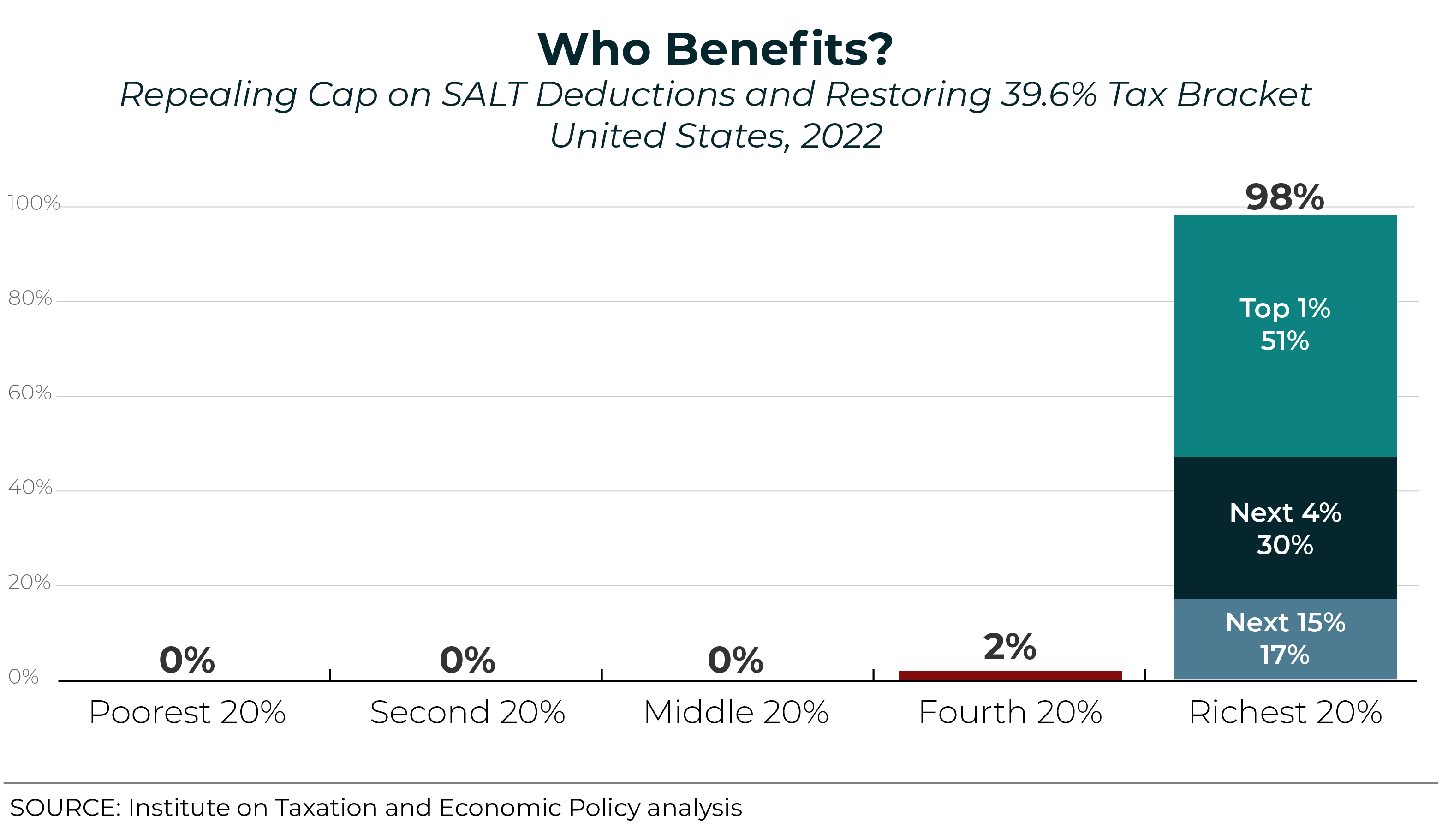

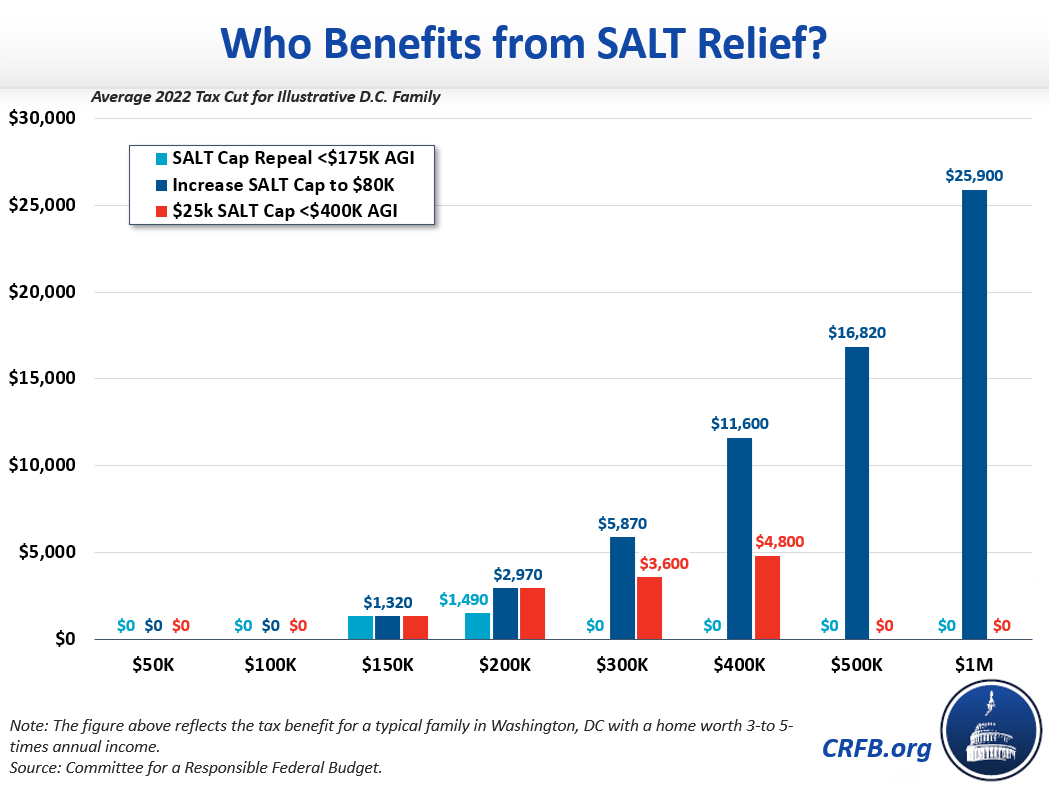

A new bill seeks to repeal the 10000 cap on state and local tax deductions. The Committee for a Responsible Federal Budget has explained that SALT cap repeal or relief is costly regressive and poor tax policy.

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Americans who rely on the state and local tax SALT deduction at tax time may be in luck.

. A rollback of the cap on the state and local tax SALT deduction is on ice after Sen. Joe Manchin D-WVa raised broader objections to President Bidens social spending and climate package. This was true prior to the SALT deduction cap and remained the case in 2018.

The deduction cap should be fully eliminated but Hill haggling may just raise it to a higher number say 15000 or 20000. Discover Helpful Information And Resources On Taxes From AARP. Improving Lives Through Smart Tax Policy.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. For your 2021 taxes which youll file in 2022 you can only itemize when your individual deductions are worth more than the 2021 standard deduction of 12550 for single filers 25100 for joint filers and 18800 for heads of household.

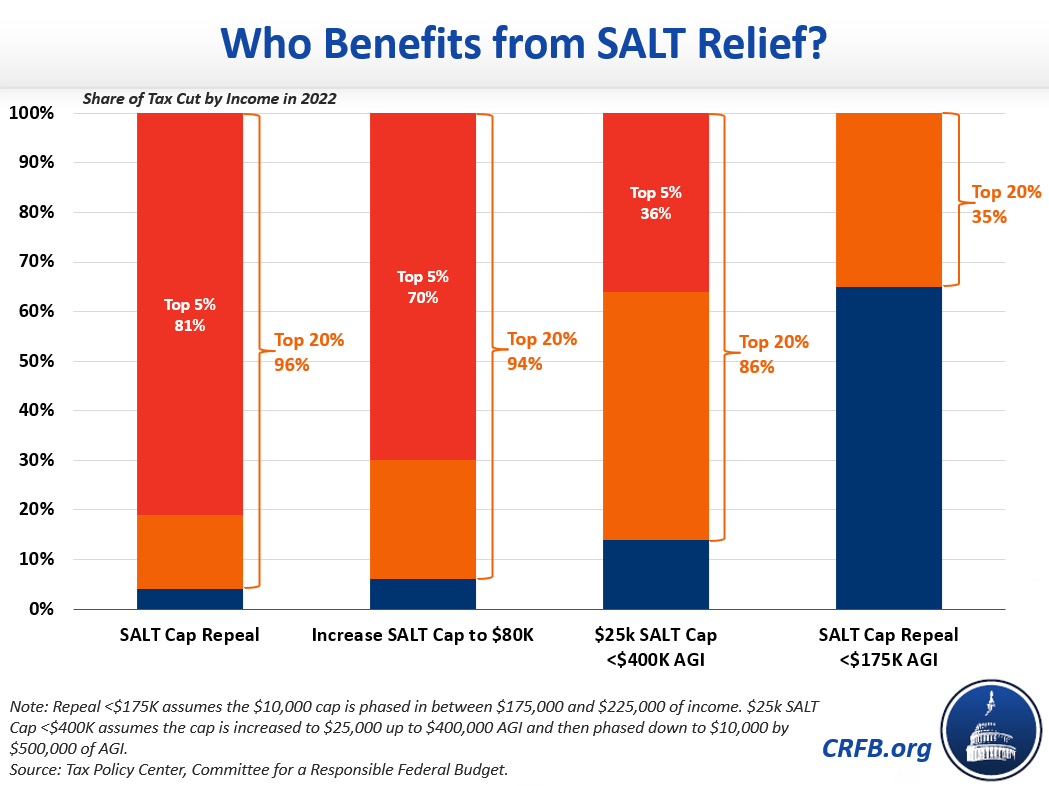

Lawmakers in high tax states particularly Democrats are pushing for a repeal of the 10000 cap on the SALT deduction. Democrats are angling to repeal a Trump-era limit on state and local tax deductions as part of President Bidens signature spending plan but a new analysis shows how the bulk of the proposal. Congressional correspondent Chad Pergram has the latest on the bill on Cavuto.

Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. Bidens DOJ is trying to preserve the 10000 limiteven though Trump enacted it. Five House Democrats are still fighting for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT.

The PorterMalinowski plan takes a middle path restoring the deduction for lesser affluent filers but keeping it in place for the rich. Senate Democrats say a proposal to raise the cap on state and local tax SALT deductions a top priority of Senate Majority Leader Charles Schumer D-NY is likely to be cut from the revised Bu. Not in these quarters.

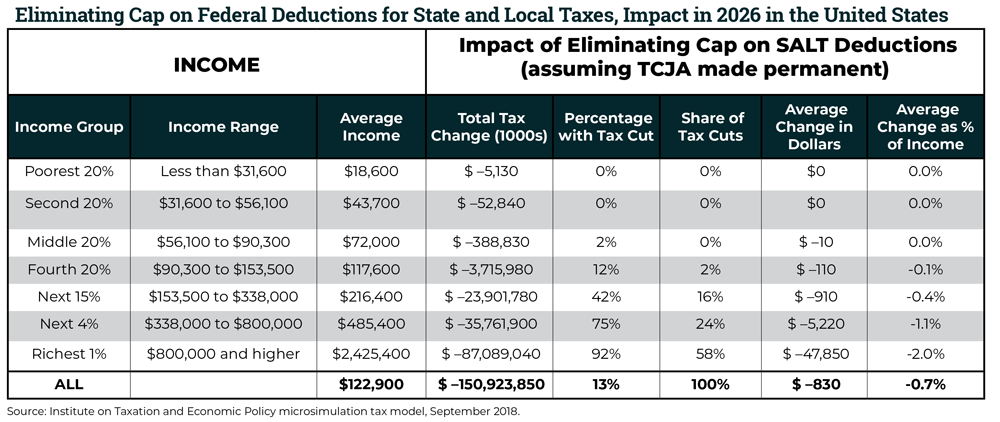

According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year or less. Prior to the Republican tax reform of 2017 tax filers could deduct all of their state and local taxes on their federal returns. A lot of progressive researchers have of course argued that this could be regressive.

The 43-52 vote Wednesday is a loss for Democrats who have been trying to chip away at the 2017 Republican tax-cut law that limited the federal deduction for state and local taxes or SALT to 10000. House Votes to Temporarily Repeal Trump. As new versions of SALT.

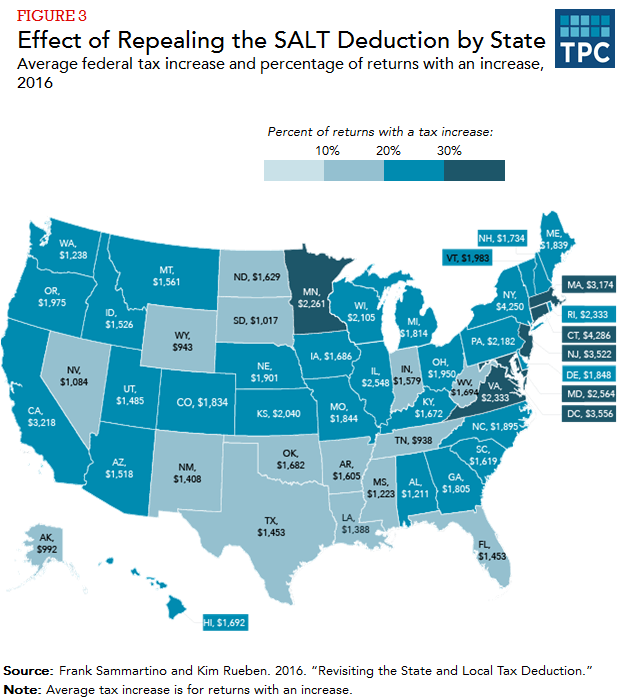

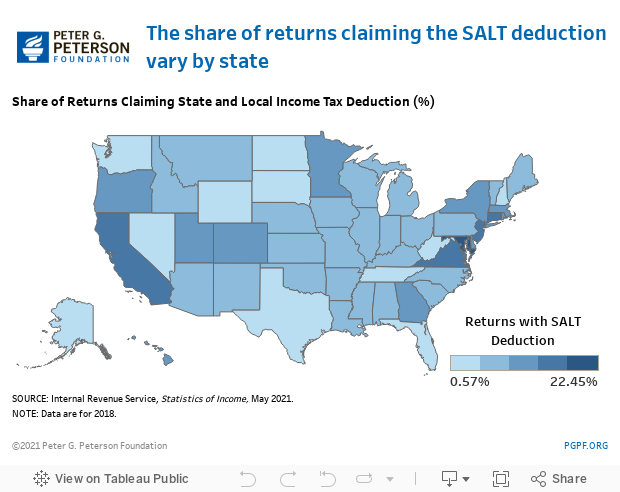

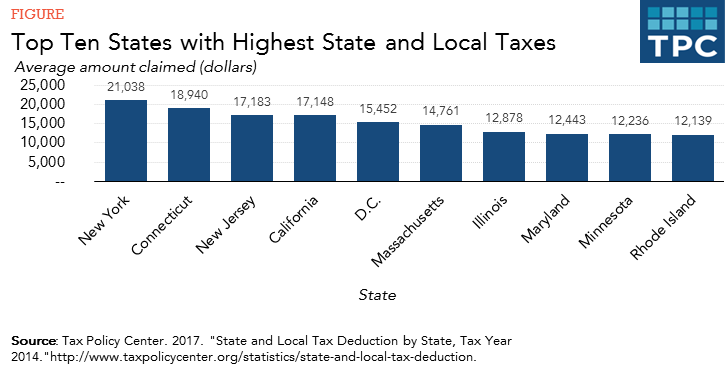

For many top elected New Jersey Democrats restoring SALT. And while its presently due to sunset in 2025 Suozzi should. The SALT deduction tends to benefit states with many higher-earners and higher state taxes.

Manchin says not so fast as NJ delegation tries to save tax break Stile. As President Bidens tax plans are considered in Congress the future of the 10000 cap for state and local tax deductions SALT is becoming an important part of the tax debate. Seven statesCalifornia New York Texas New.

Blue states like New York and California want to restore the unlimited state and local tax or SALT deduction. Certain members of the House and Senate want the SALT deduction cap removed which would benefit primarily higher earnersand result in a. The SALT deduction is overwhelmingly used by high-income individuals which could make the tax code more regressive.

At least hes trying. But such a repeal would mostly benefit high-income taxpayers and force the. SALT Cap Repeal Below 500k Still Costly and Regressive.

As he said Monday about the repeal of the SALT cap If it doesnt happen I will look like an idiot. With Biden considering major tax reform one of the proposals on the table is the potential repeal or reform of the SALT cap. This would be in place of the House plan to lift the cap to 80000 through 2030 and reinstate it at 10000 for 2031.

Some Democrats look into SALT tax deductions for 35 trillion spending bill. Lawmakers are currently considering possible changes to the state and local tax SALT deduction. The lawmakers are urging colleagues to block.

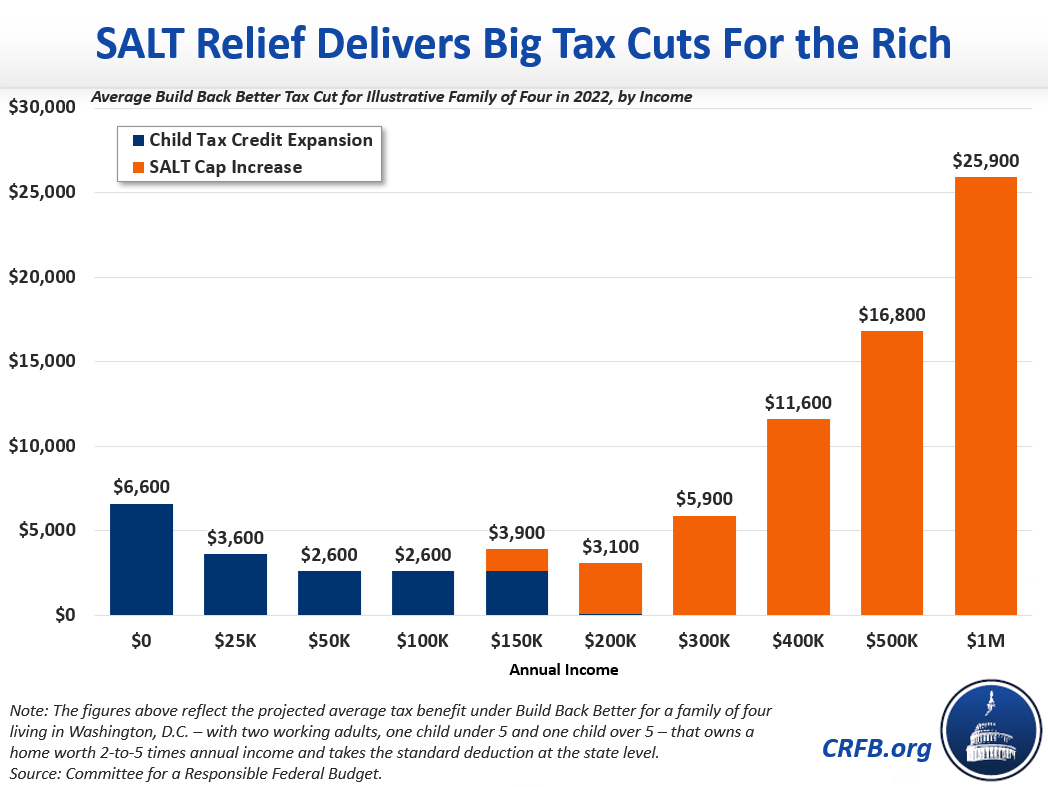

A deal later announced between Manchin and Senate Majority Leader Chuck Schumer on a fiscal package that spans tax climate and health care measures also omitted any SALT-cap expansion. The House-passed Build Back Better Act for example would raise the cap from 10000 to 80000. 54 rows The expansion of the standard deduction further limited the value of the SALT deduction for taxpayers under the 10000 cap.

52 rows The SALT deduction is only available if you itemize your deductions using Schedule A.

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

This Bill Could Give You A 60 000 Tax Deduction

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Bullish Streaks The Stock Market Was Down Slightly On Thursday But The Amazing Year For Stocks Continues The Chart Below Shows Stock Market Chart Income Tax

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

Why Repealing The State And Local Tax Deduction Is So Hard

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

U S Lawmakers Pepper Congress With Pleas For Salt Tax Break Florida Phoenix